In 2023/24, LHSC continued to navigate financial challenges currently facing the larger health-care system, including growing patient volumes, higher care complexity, sustained inflation, staffing needs and continued pandemic recovery. Wages for health-care workers and purchasing health-care supplies are the largest costs within our budget. A planned deficit budget allowed LHSC to continue advancing quality care, teaching, and research while addressing operational and strategic improvements.

As we look ahead, we are developing a multi-year budget strategy to return to a balanced financial position. This includes assessing our current operations to optimize fiscal processes, seek efficiencies and prioritize a sustainable financial strategy. By optimizing our operations and advancing strategic partnerships, we will ensure that LHSC is the collaborative, leading-edge health-care provider that we are and that our community expects us to be.

Opinion

The summary financial statements, which comprise the summary statement of financial position as at March 31, 2024, and the summary statement of operations and summary statement of cash flows for the year then ended, and related notes, are derived from the audited financial statements of London Health Sciences Centre for the year ended March 31, 2024.

In our opinion, the accompanying summary financial statements are consistent in all material respects, with the audited financial statements, in accordance with the basis of presentation note.

Summary Financial Statements

The summary financial statements do not contain all the disclosures required by Canadian public sector accounting standards. Reading the summary financial statements and the auditor's report thereon, therefore, is not a substitute for reading the audited financial statements and the auditor's report thereon. The summary financial statements and the audited financial statements do not reflect the effects of events that occurred subsequent to the date of our report on the audited financial statements.

The Audited Financial Statements and Our Report Thereon

We expressed an unmodified audit opinion on the audited financial statements in our report dated May 29, 2024.

Management's responsibility for the summary financial statements

Management is responsible for the preparation of a summary of the audited financial statements on the basis described in the basis of presentation note.

Auditors' responsibility

Our responsibility is to express an opinion on whether the summary financial statements are a fair summary of the audited financial statements based on our procedures, which were conducted in accordance with Canadian Auditing Standard 810, Engagements to Report on Summary Financial Statements.

(signed) Ernst & Young LLP

Chartered Professional Accountants, Licensed Public Accountants

London, Canada, June 3, 2024

Summary Statement of Financial Position

London Health Sciences Centre (LHSC) expected its financial position to be challenged during the past year as a result of its Ministry of

Health approved deficit budget of $75.5 million. Liquidity remained within performance standards despite an uncertain funding environment, and

the impact of the repeal of Bill 124, which saw significant increases in wages of hospital employees across the province. LHSC's current ratio

of 0.85 reflects the cost of the deficit budget and LHSC's continued investment in the future. Current and long-term obligations under various

debt agreements are adequately covered, based on the current cash position. Looking ahead, LHSC will continue to employ deliberate strategies

to support our workforce and address the health service needs of our growing and diverse community, whilst remaining fiscally responsible.

Summary Statement of Operations

LHSC ended the year with a deficit of $78.1 million. This position is largely the result of unprecedented healthcare human resource

challenges, high inflationary impacts, and changes in patient demographics and healthcare utilization patterns.

Actual revenues ($1,686 million) were higher than budget ($1,581 million) primarily due to revenues from the Ministry of Health that were unanticipated and hence not budgeted.

Actual expenses ($1,764 million) were higher than budget ($1,656 million) primarily due to the increased wages and benefits for hospital employees as a result of the repeal of Bill 124, as well as the inflationary pressures on supplies and expenses.

Summary Statement of Cash Flows

LHSC invested $47.0 million in clinical capital, building service equipment, information systems and buildings during the year. In addition,

LHSC spent $29.9 million on externally funded or recoverable capital projects.

Capital spending is financed through a combination of operations, debt and deferred contributions from government, the London Health Sciences Foundation and Children's Health Foundation.

Current assets include restricted cash and portfolio investments of $7.3 million in order to discharge certain future obligations and $157.6 million in unrestricted cash and cash equivalents.

Basis of Presentation

The information contained in the summary financial statements is in agreement with the related information in the complete audited financial

statements. The summary financial statements contain major subtotals and totals from the complete audited financial statements. View the complete audited financial

statements

| YEAR ENDED | March 31, 2024 | March 31, 2023 |

| (000’s) | (000’s) | |

| REVENUE | ||

| Ministry of Health and Ontario Health | 1,418,904 | 1,272,533 |

| Other | 267,252 | 261,489 |

| 1,686,156 | 1,534,022 | |

| EXPENSES | ||

| Salaries and benefits | 1,103,953 | 991,013 |

| Other | 660,281 | 589,477 |

| 1,764,234 | 1,580,490 | |

| Deficit | (78,078) | (46,468) |

| YEAR ENDED | March 31, 2024 | March 31, 2023 |

| (000’s) | (000’s) | |

| CASH PROVIDED BY (USED IN) | ||

| Operating activities | (23,891) | 42,911 |

| Financing activities | 17,722 | 15,926 |

| Investing activities | (3,447) | 1,937 |

| Capital activities | (76,922) | (70,819) |

| Net decrease in cash and cash equivalents | (86,538) | (10,045) |

| Cash and cash equivalents, beginning of year | 244,128 | 254,173 |

| Cash and cash equivalents, end of year | 157,590 | 244,128 |

| AS AT | March 31, 2024 | March 31, 2023 |

| (000’s) | (000’s) | |

| ASSETS | ||

| Current assets | 296,008 | 391,498 |

| Restricted cash, investments, and interest rate swaps | 18,974 | 12,943 |

| Capital assets, net | 958,645 | 948,885 |

| 1,273,627 | 1,353,326 | |

| LIABILITIES, DEFERRED CONTRIBUTIONS, NET ASSETS AND REMEASUREMENT LOSSES | ||

| Current liabilities | 349,030 | 346,578 |

| Long-term liabilities and deferred contributions | 781,876 | 788,462 |

| Internally restricted net assets | 33,788 | 37,714 |

| Unrestricted net assets | 106,215 | 180,367 |

| Accumulated remeasurement gains | 2,718 | 205 |

| 1,273,627 | 1,353,326 | |

|

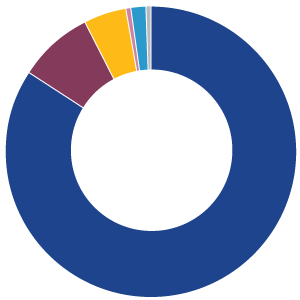

Total Revenue (%) by Type $1,686 Million |

||

|

Ministry of Health and Ontario Health: 84.2% | |

| Non-patient: 8.4% | ||

| Patient: 4.8% | ||

| Preferred accommodation: 0.4% | ||

| Amortization of deferred capital contributions: 1.9% | ||

| Interest: 0.3% | ||

|

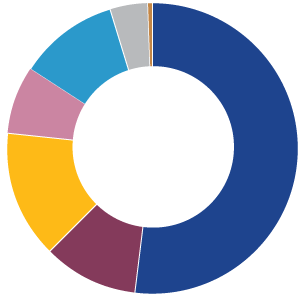

Total Expense (%) by Cost Component $1,764 Million |

||

|

Salaries and wages: 52.0% | |

| Employee benefits: 10.6% | ||

| Supplies and other: 14.1% | ||

| Medical and surgical supplies: 7.7% | ||

| Drugs: 10.9% | ||

| Amortization of capital assets: 4.2% | ||

| Interest and other: 0.5% | ||

|

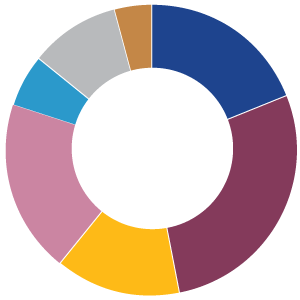

Total Expenses (%) by Type $1,764 Million |

||

|

Administration and support: 19% | |

| Inpatient services: 28% | ||

| Outpatient services: 14% | ||

| Diagnostic and therapeutic: 19% | ||

| Other votes: 6% | ||

| Undistributed: 10% | ||

| Amortization: 4% | ||